Allstate Drivewise review + final results (2023)

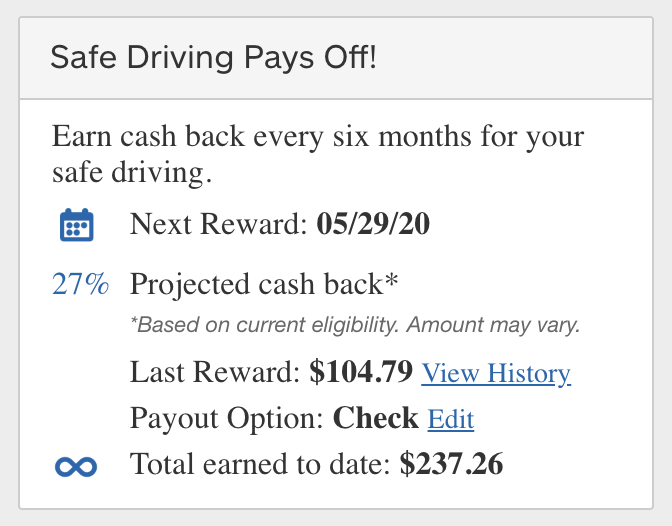

I’ve personally had Allstate Insurance for just over a year (I switched from Progressive), which means I’ve been able to go through two full auto insurance renewals using the Drivewise feature on their mobile app. At both renewals, I’ve gotten a check back for 27% of my premium (!!!) but there are a few things I’m not a fan of with the app.

What is Drivewise from Allstate?

Drivewise allows you to lower your insurance rates by tracking your personal driving habits through Allstate’s mobile app. The safer you drive, the more you’ll save in the form of cash back on your auto insurance policy renewal.

How much does Allstate pay you for safe driving?

You’ll earn up to 25% cash back if you sign up for Drivewise each renewal when you track at least 50 trips using their mobile app. More specifically, here’s what Allstate pays you in the form of cash back for participating in Drivewise:

- Up to 10% cash back for signing up for the Drivewise program

- Up to 25% cash back every six months on renewal

- Additional rewards points for completing safe driving challenges, which can be redeemed for discounted gift cards

In the year that I’ve been with Allstate Insurance, I’ve earned more than $200 in cash back by using their Drivewise feature. Check it out:

What does Drivewise track?

Allstate needs to track a few things to determine if you’re a safe driver. This sounds creepy, but it is necessary for them to provide you with a personalized insurance premium. When tracking your driving, Allstate is watching the following:

- Speed – do you drive under 80mph? Allstate considers any speed under 80mph to be safe, as long as you’re driving at a reasonable hour and limit hard braking.

- Hours – do you drive at a safe time? Driving between the hours of 11PM – 4AM on weekdays and 11PM – 5AM on weekends will give you negative marks.

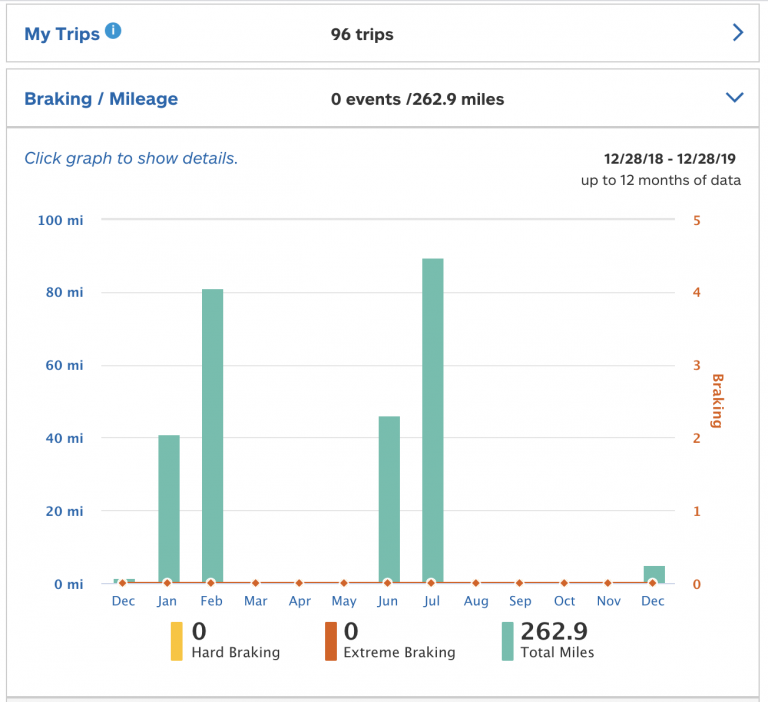

- Stops – do you slam on your breaks? Allstate tracks hard-breaking and extreme braking. Hard braking occurs when you decelerate 8 mph or more (but less than 10 mph) in one second. Extreme braking occurs when you decelerate at 10 mph or more in one second.

Allstate also uses your phone’s GPS to track your location so they know where you’re driving while using the Drivewise feature. I personally have permissions set so that Allstate only knows my location when I have the app open.

Final Drivewise results

I’m going to keep using Drivewise. It is an easy way to save money as I typically drive locally. You only need to track 50 trips each policy period so its not like Allstate knows everywhere you go.

I do have a complaint about Drivewise, though…

Allstate’s mobile app isn’t the best, but it is getting better. It regularly crashes and drains my battery FAST! This is likely due to using my GPS to track my location, speed, etc. but it can be annoying.

Overall, if Allstate offers you the lowest-priced auto insurance, I recommend adding Drivewise to your policy to save even more money. It is easy to use and I love getting a check in the mail every few months.

The app still needs some improvement. shows I’ve taken 0 of 50 trips. it is not updating my trips. Since signing up again in Late December of 2023 I have taken numerous trips?