Amex Retention Offers + Data Points & Guide [2025]

American Express offers attractive welcome offers to sign up for their credit cards, but what happens after the first year? While most Amex cards come with great benefits, those benefits also come at a price in the form of an annual fee (and that fee can sometimes be hefty!).

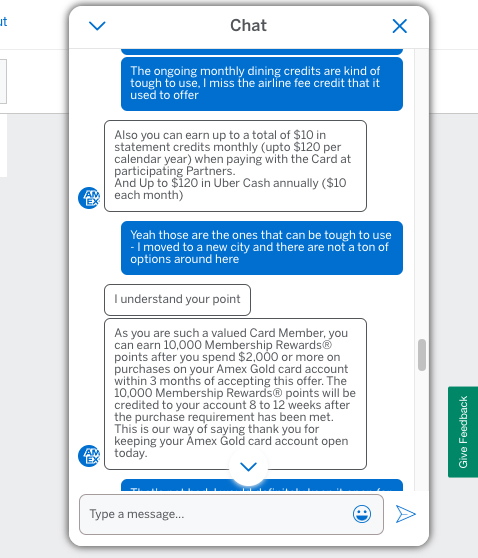

If you’re on the fence about paying your Amex annual fee, you may be able to get extra perks by contacting them to inquire about a retention offer. Credit card companies like Amex, Citi, and Chase sometimes offer retention offers to entice you to keep your card open for another year. This isn’t offered to everyone but can be lucrative if available on your account. Retention offers usually waive the annual fee or offer points in exchange for your commitment to keep the card open.

Historical Amex Retention Offers

While your annual card spend and length of card membership matter most, American Express does change its retention offers throughout the year. Nothing is guaranteed, even if you have spent thousands of dollars on your card.

The Platinum Card Retention Offers

The American Express Platinum Card has a whopping $695 annual fee. While it offers great benefits like Centurion Lounge access it is hard for manual to stomach this annual fee every year.

This year, we’ve seen reports on sites like Reddit and Flyertalk that the following retention offers are being offered for the Platinum Card:

- 55,000 Membership Rewards points when you spend $4,000 in 3 months

- 50,000 Membership Rewards points when you spend $4,000 in 3 months

- 45,000 Membership Rewards points when you spend $4,000 in 3 months

- 30,000 Membership Rewards points when you spend $3,000 in 3 months

- 25,000 Membership Rewards points when you spend $3,000 in 3 months

- 20,000 Membership Rewards points when you spend $3,000 in 3 months

- $550 statement credit when you spend $4,000 in 3 months

- $300 statement credit when you spend $3,000 in 3 months

Amex Gold Card Retention Offers

While the American Express Gold Card offers a ton of credits that effectively offset its annual fee, $250 is still a lot of money. Here are some common Amex Gold Card retention offers:

- 30,000 Membership Rewards points when you spend $3,000 in 3 months

- 20,000 Membership Rewards points when you spend $2,000 in 3 months

- 15,000 Membership Rewards points when you spend $2,000 in 3 months

- 10,000 Membership Rewards points when you spend $2,000 in 3 months

- $100 statement credit when you spend $1,500 in 90 days

Amex Green Card Retention Offers

The Amex Green Card has a $150 annual fee, which is much less than the Platinum and Gold cards. Regardless, American Express is also offers retention offers for this card.

- 15,000 Membership Rewards points when you spend $2,000 in 3 months

- 10,000 Membership Rewards points when you spend $1,000 in 3 months

- 7,500 Membership Rewards points for no additional spend

- $125 statement credit when you spend $2,000 in 3 months

Delta SkyMiles Reserve Retention Offers

- 60,000 SkyMiles when you spend $4,000 in 3 months

- 50,000 SkyMiles when you spend $5,000 in 3 months

- 50,000 SkyMiles when you spend $3,000 in 3 months

- 7,500 SkyMiles when you spend $1,000 in 3 months

Delta SkyMiles Platinum Retention Offers

- 30,000 SkyMils with no spend requirement

- 15,000 Skymiles when you spend $1,000 in 3 months

- $100 statement credit when you spend $1,000 in 3 months

Hilton Honors Aspire Retention Offers

The Hilton Aspire card is one of the most rewarding credit cards out there. Retention offers for this card are rare, but they are out there.

- 80,000 Hilton Honors points when you spend $3,000 in 3 months

- 20,000 Hilton Honors points with no spend requirement

- 10,000 Hilton Honors points when you spend $1,000 in 3 months

There are also reports of people being offered statement credits of $100 to $350 with no spend requirement.

Hilton Honors Surpass Retention Offers

- 60,000 Hilton Honors points after spending $3,000 in 3 months

- 10,000 Hilton Honors points after spending $1,000 in 3 months

Marriott Bonvoy Brilliant Retention Offers

- 60,000 Marriott Bonvoy points when you spend $2,000 in 3 months

- 25,000 Marriott Bonvoy points when you spend $3,000 in 3 months

- 25,000 Marriott Bonvoy points when you spend $1,000 in 3 months

- $250 statement credit when you spend $3,000 in 30 months

Tips To Get Higher Amex Retention Offers

While you’re not guaranteed to get a retention offer for your Amex card, there are several tips to keep in mind to increase your odds:

- Use your card! Amex is more likely to offer you a retention offer if you have used your card.

- Ramp up your spend ~3 months before the annual fee posts

- You can receive a retention offer every 13 months. I ask for one every other year.

- It’s okay to downgrade – you may be offered an upgrade offer at some point

- Close your card if you don’t get value from it (unless it is your only credit card).

Closing Thoughts

American Express is one of the most rewarding credit card issuers, thanks to their lucrative signup bonuses and ongoing perks. American Express can offer all of this by charging annual fees. Sometimes, though, you may be on the fence on renewing your card another year and paying that hefty fee. Hopefully, this article helps you understand what offers may be available for your account, and how to increase your odds at receiving a retention offer in the future.

Have you received an Amex retention offer? Let us know in the comments!