Capital One Retention Offers + Data Points [2025]

Capital One lures you in with attractive signup bonuses and welcome offers, but what happens after the first year? While Capital One offers solid rewards for using their cards, some of them (like the Venture X) come with a hefty annual fee.

If you’re on the fence about keeping your card open for another year, you may be able to get Capital One to offer a retention offer. All you need to do is ask! Capital One, like Chase, and Citi, sometimes will waive your annual fee if you promise to keep your card open for another year. While Capital One doesn’t offer this every time, it is always worth asking.

Historical Capital One Retention Offers

Capital One can be tricky with offering retention offers, but you may be able to get a statement credit if you have a card with an annual fee.

Here are some typical retention offers for Capital One cards:

Capital One Venture X Card

There are no known reports of a retention offer for the Venture X card. While the card has a hefty annual fee, Capital One essentially pays you to use this card every year. In addition to the annual $300 travel credit, Capital One automatically gives you 10,000 bonus miles every anniversary.

Capital One Venture Card

There are several reports on Reddit stating that Capital One usually offers to waive the annual fee on the Venture card if you ask. You will receive a $95 statement credit if this is available for your account. Otherwise, you should be able to downgrade to the VentureOne card that doesn’t have an ongoing fee.

Capital One Savor Rewards Card

Just like the Venture card, Capital One is known to offer a $95 statement credit if you ask them to waive the annual fee for your Savor Rewards card. You may also downgrade to the SavorOne card, which doesn’t have an annual fee.

Capital One Spark Card

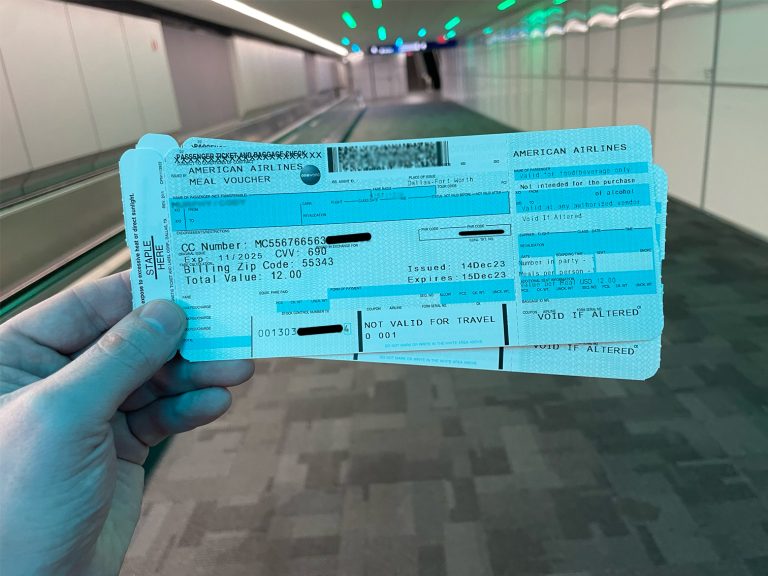

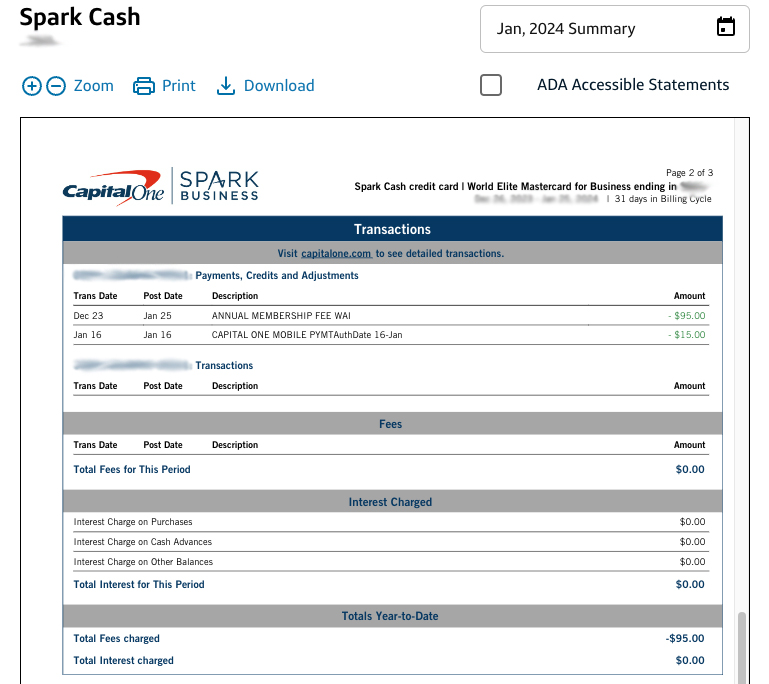

Capital One has waived the annual fee for my Spark Cash credit card for the last two years! I don’t use it much anymore and still had success getting it waived this year. This took less than 5 minutes to ask for, and no additional spend was offered. They simply added a credit to my account equivalent to the annual fee.

Here’s what it looks like on my statement:

Closing Thoughts

While Capital One isn’t known to offer generous retention offers like American Express, there is a good chance you may get them to waive your annual fee if you commit to keeping your card open for another year. It is always worthwhile to give them a call and ask (call the number on the back of your card after your annual fee is charged).

Have you had luck with getting Capital One to waive your annual fee? Share your experience in the comment section!