The r/Churning Credit Card Flow Chart [2025]

While you’re probably familiar with points & miles blogs (hey, you’re on our website!) you may not realize that Reddit also has several resources dedicated to earning points and miles. They are called subreddits, and one of the most popular is r/Churning. Nearly 600,000 members contribute to daily threads for news, questions, and data points. It’s a great spot to find the latest points and miles news!

One super handy resource maintained by the r/Churning community is the credit card recommendation flow chart, created by Redditors /u/kevlarlover, /u/goatfresh, and now maintained by /u/m16p.

What is the credit card flow chart?

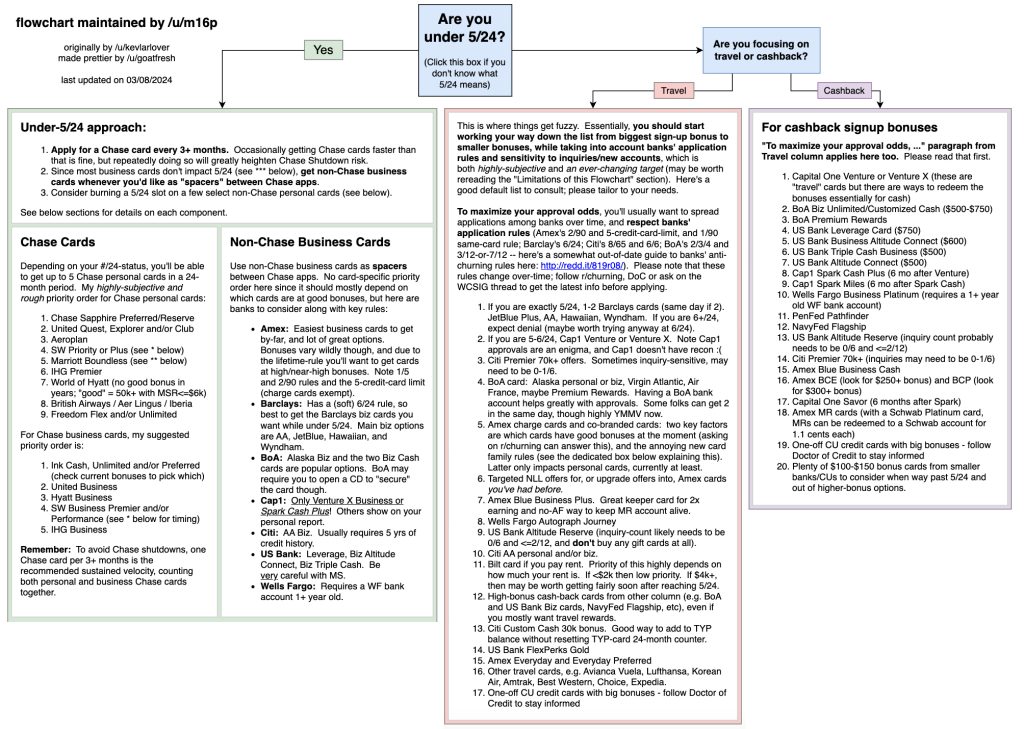

The Reddit credit card flow chart provides guidance for what cards to open if you’re looking to open a new credit card. The flowchart prioritizes your 5/24 status and whether you’re focusing on travel rewards or cash back. This is helpful because many banks are sensitive to how many credit cards you have recently opened, and using the flow chart helps increase your approval odds.

What the heck is 5/24?! Your 5/24 status refers to the number of credit cards you have opened in the last 24 months. If you are under 5/24, you have opened fewer than 5 credit cards while over 5/24 means you have opened 5 or more cards in the last two years.

The Reddit Churning Flowchart

Below is a screenshot of the flow chart as of March 2024, click here to see the most up-to-date version.

You can see this is a very detailed chart, that covers recommendations for most of the major banks, including American Express, Capital One, and Chase.

At a high level, this is the order of recommendations:

- If you’re under 5/24, focus on Chase cards. You can get up to 5 Chase personal cards in 24 months if you’re starting from 0/24. But wait at least 3 months between applications to lower your chance of Chase closing your accounts.

- Consider opening business cards between Chase applications from non-Chase banks. Business cards from banks like American Express, Barclays, and Citi don’t show up on your personal credit report (which means they don’t add to your 5/24 status).

- If you are above 5/24, focus on the largest welcome bonus (at a non-Chase bank). Check out the chart for dozens of different card recommendations!

One of the best reminders from the r/Churning flowchart is that churning is a marathon, not a sprint. It may take years to get every card!

If you feel like you are applying for cards too fast, consider asking for retention offers on your existing cards. Card issuers like American Express and Chase offer retention bonuses if you commit to keeping a card open for another year.

Closing Thoughts

The Churning subreddit can be a goldmine of points and miles recommendations, and the churning flowchart is just one example of that. The chart offers tips based on your 5/24 status, whether you’re focused on travel or cash rewards, and incorporates recommendations for most of the major banks. While it is easy to get excited about the bonuses that the best credit cards offer, it’s important to remember that this hobby is a marathon, not a sprint. It’s okay to take your time!

Would you change any of the Churning flowchart recommendations? Leave a comment!